Seafarers are highly paid. They have a yearly renewal of contract that last as short as 4 months to as long as one year. Most usual, high ranking officers get on board for 4 months, while low rank seafarers go on board for about 8 months every year. They have to go through training and certification each year to get promoted to the next level to increase their rank and pay.

They usually, have healthcare only when on-board. Some even have coverage for their extended families. Some don’t. They don’t get paid when they are not on-board or under training. In fact, they have to pay for their own Training and Certification. They don’t have 13th month pay. They also don’t have retirement pay. They usually invest on properties, cars, and huge houses. These are what makes them different from most profession. These are the reasons why, they need a different approach into investment and protection.

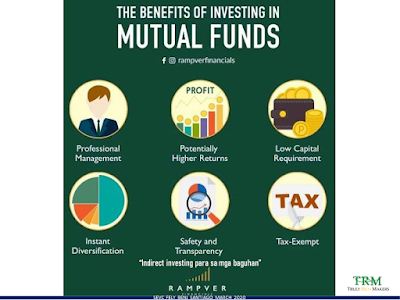

The advantage of a seafarer is their income. They just have to learn how to budget, and how to invest correctly with their spouse, and children. They have to invest the retirement pay they already receive in advance. They need to make sure they divide the total income they receive per year by 12 so they can budget it correctly. Unless they save and invest, they don’t have retirement funds to rely on for they already spent it.

You see, even if they start at age 30, with just 3,000Php/Month which they easily can save and invest, they could accumulate 10.3M Php by the time they turn 60. They can happily retire with financial freedom with more than 1M/Year Interest Earning from their investment.

I am calling all SEAFARERS, Join me in my FREE ON LINE WEBINARS so you can Learn How to Invest Correctly and achieve your Financial Goals. Register HERE NOW: http://8874hf.trulyrichmakers.com/investingcorrectly/

Let me know if you need assistance

in getting into your Webinar Room.

Check here to see the many benefits of becoming an IMG Member. You may even win an iPad Mini: